Everyone loves a new build.

Whether it's property or infrastructure, they're a city's shiny new toys.

Star ratings, innovative technologies, special features and media fanfare.

They give the creators a chance to show what's possible and lead the market one step further to net positive outcomes and a sustainable future.

And give all stakeholders an opportunity to demonstrate real impact in relation to their sustainability goals. But what of the 'new builds' of the 80's, 90's and 00's? The hundreds of thousands of buildings and systems that faithfully run our cities.

Can old buildings meet new targets? Is each and every one of them an opportunity in the waiting, just needing the imagination and determination to make it happen?

We think so.

It's a good idea.

Whether you're talking about cost saving or climate change, retrofitting is a good idea.

The world's buildings contribute roughly a quarter of all greenhouse gasses. And of these, the biggest opportunity to create carbon savings between now and 2030 is in retrofitting existing buildings and replacing energy-thirsty equipment.

In Australia alone, 81% of commercial buildings are 10 years or older. In each of these, energy savings of 50-75% can be achieved by well-designed energy efficiency measures. Ladder this to impact and existing building retrofits could potentially result in 100Mt GHG savings.

In dollar terms, that is a potential for $9b in cost savings between 2015 and 2030. To date, energy intensity has improved only 2% across the commercial sector. All of which points to a very rich vein of cost and carbon savings, waiting to be mined. And it gets bigger.

Energy is one opportunity, but water systems can also be retrofitted for considerable savings. And this can often be done in a way that complements the energy systems, providing integrated opportunities when designed together.

It's challenging.

So, what's stopping us?

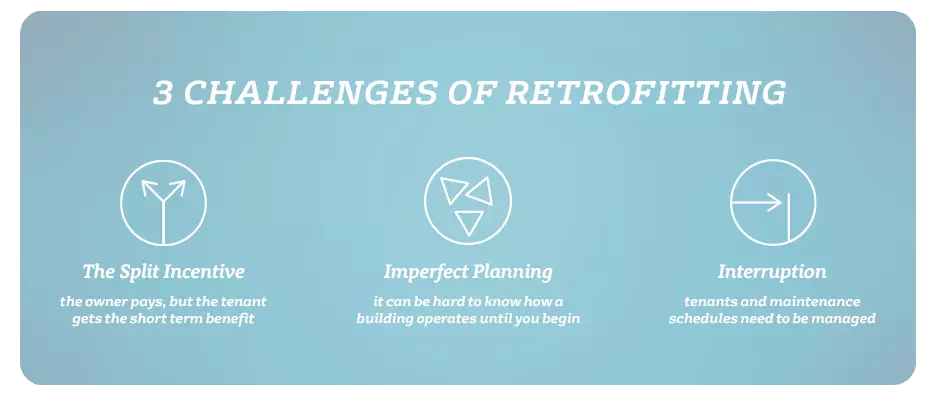

For one, finance. Often retrofitting is a long-term proposition whereas finance is not. And it's about timing. 'Split incentives' mean building owners foot the bill while tenants get the benefit.

Secondly, planning is not a perfect science. Even with the best feasibility study, there are unknowns in a building's systems. As such, the best retrofits work to an agile process that outlines key costs and milestones, but can be adapted as it goes.

Finally, existing tenants and schedules. Unlike a new build, retrofitting happens on a living, working asset. Existing maintenance and management schedules must still be met and tenants need to be brought along for the journey since there is the possibility of inconvenience in their operations. At which point stakeholder engagement can become both key, and costly.

It's OK, help is on the way.

Back to the good news. In recent years, retrofitting has come a long way. When it comes to finance, Environmental Upgrade Agreements provide a longer timeframe for finance that better matches the retrofit return.

They also help share the burden and benefit between tenants, owners and investors, removing the split incentive. The Better Building Finance Corporation is a great example of an organisation set up to meet this new market in financial products.

This shared incentive model also extends to service providers. In recent retrofits, Veolia has worked with the client to set energy and water reduction targets as well as constant improvements over time via Performance Contracts. This ongoing improvement approach to both the retrofit and remuneration shares incentive and creates effective, long-term partnerships.

Expertise is also on the rise. The more retrofits happen, the better the industry gets. Standardised, plug-in solutions start to become available and processes are put in place to plan for unknowns and make the agile process less opaque. International experience becomes localised. Costs come down, as do timelines. As expertise rises, so too do integrated solutions. This is Veolia's big area of expertise.

Retrofitting one system has rewards, but when you redesign them to work seamlessly together, benefits are multiplied.

The reward.

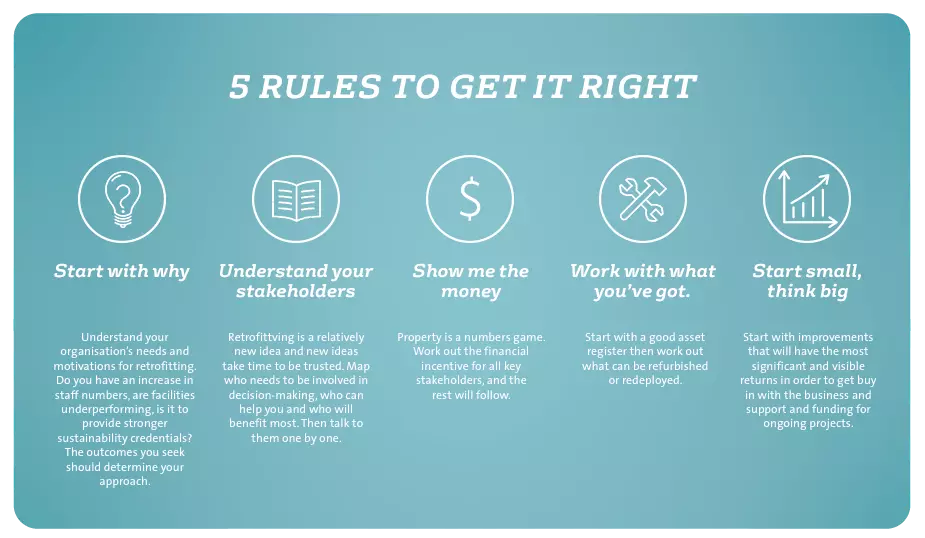

So, all in all, the barriers can seem daunting but the rewards are worth the learning curve. A retrofit asset is, in many ways, a new asset with a new lifespan, at a fraction of the cost of a new build.

As well as renewing the asset, it is a chance to create a new kind of relationship between owners, investors and tenants. Long-term thinking is applied, so long-term leases follow. And let us not forget the people whom the asset is built to serve. A retrofit asset gives new life to the people who work in or depend on it. Employee engagement goes up, and that's good for business too.

And finally, you start to become an expert in an area with almost endless opportunity. Currently, retrofits are the elephants in the sustainability room, but given the size of both the climate problem and the financial upside, that has to change. And soon.

Today's pioneers are tomorrow's leaders. The skill is there, the tools are ready. The question is, are you?

5 reasons to retrofit.

- It creates a new asset at a fraction of the cost

- New financial products have removed the biggest barrier

- There are big cost savings to be had

- It turns the lessor/tenant relationship into a partnership

- There are few experts in the market, so the opportunity is there to learn and specialise

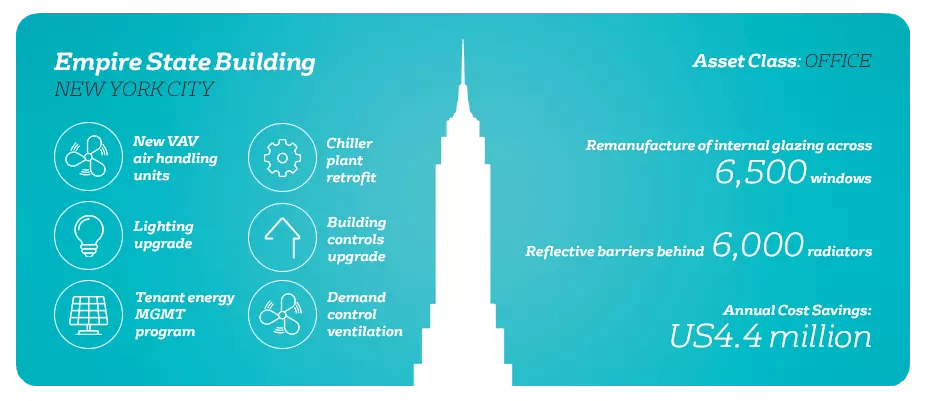

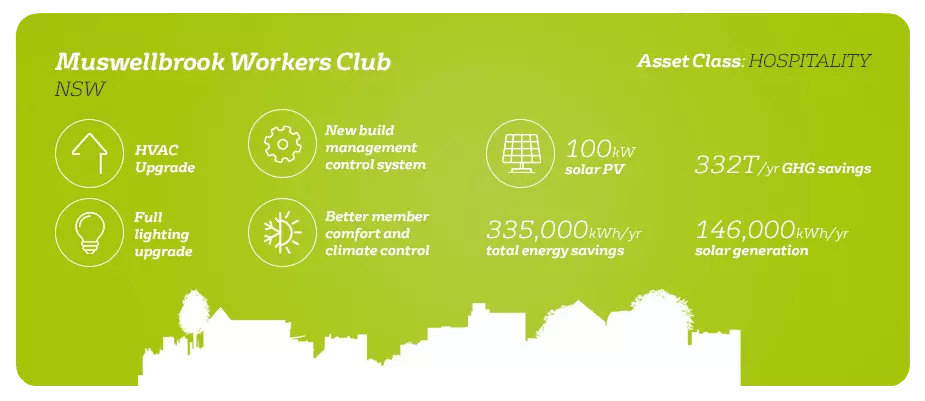

5 great examples: